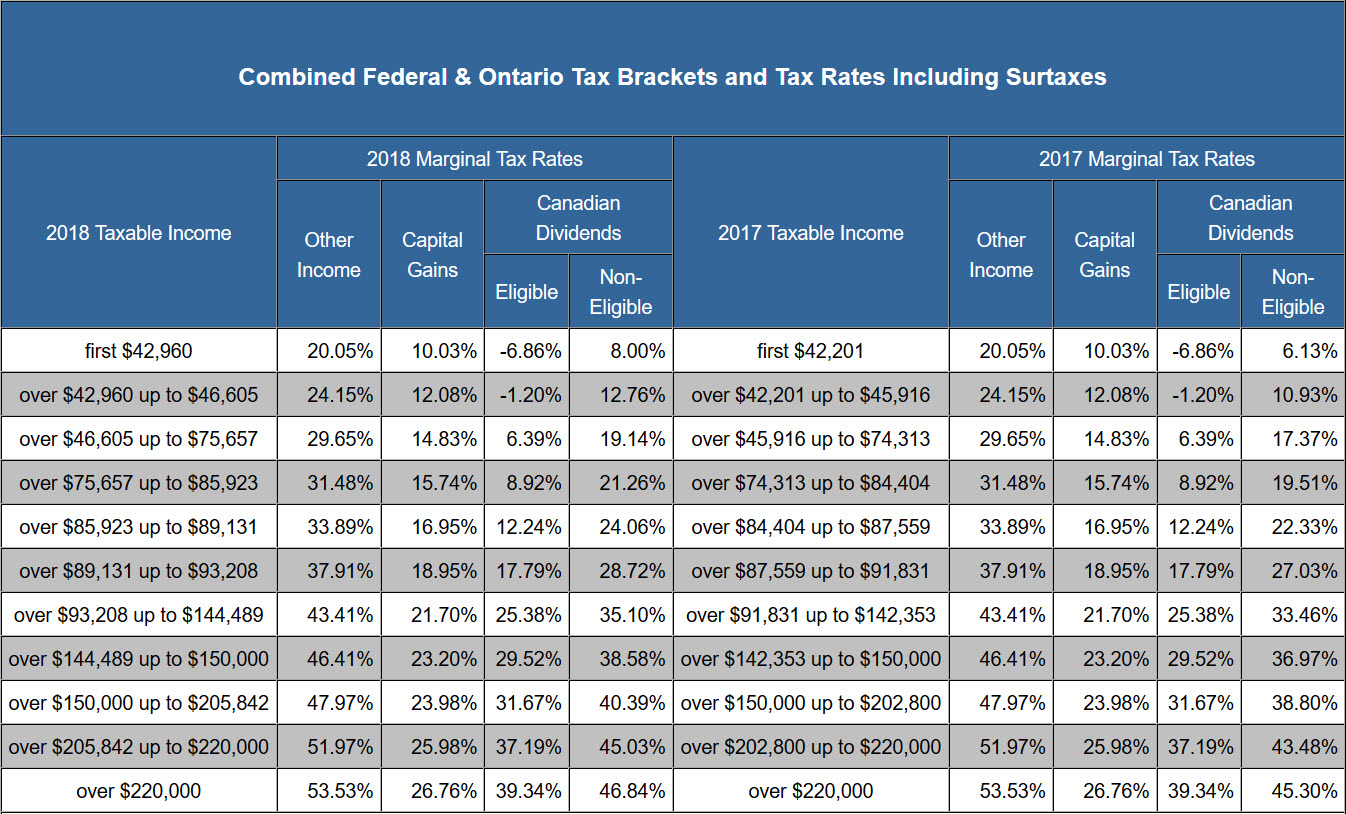

Income Tax Rates Ontario 2025. Determine the tax rate applied to different portions of your income earned within ontario. The surtax increases the 13.16% tax rate to 20.53% (13.16% x 1.56).

The tax is calculated separately from federal income tax. 20% surtax on tax over $5,554 and additional surtax of 36% on tax over $7,108.

Tax Calculator 2025 Ontario Image to u, Here are the tax brackets and corresponding rates for 2025:

Personal Tax Brackets Ontario 2025 MD Tax, Here are the tax brackets and corresponding rates for 2025:

Ca Tax Brackets 2025 2025, 20% surtax on tax over $5,554 and additional surtax of 36% on tax over $7,108.

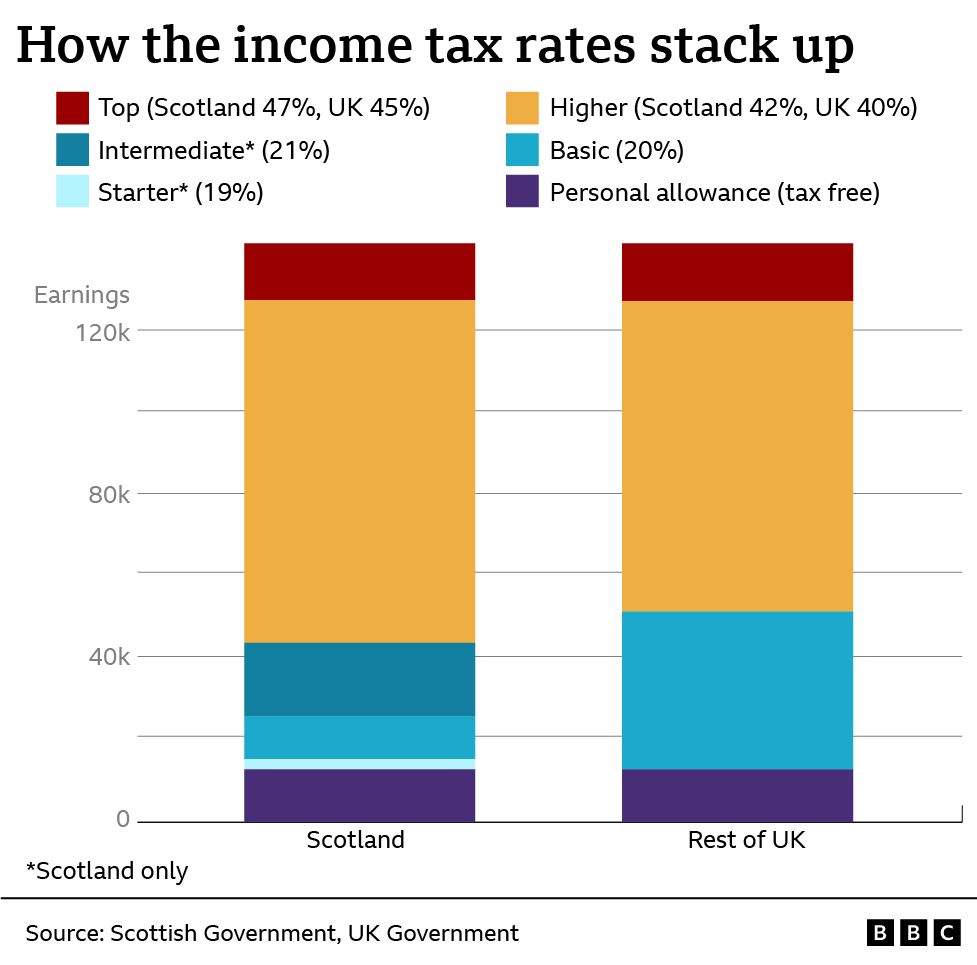

What taxes will you pay in Scotland? BBC News, Our partners and experts have prepared for your reference, tax rates tables which capture federal and provincial tax rates information for ontario.

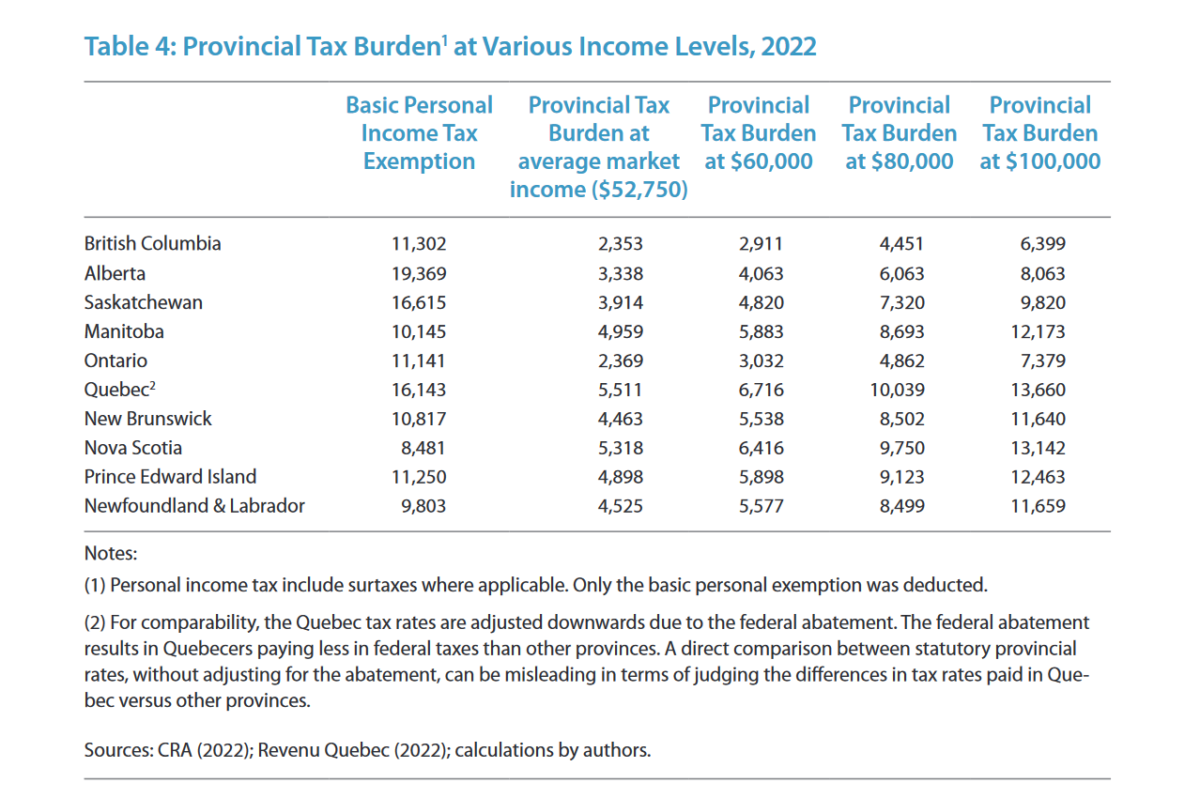

Tax Comparison These Provinces Have the Least Tax in Canada, 20% surtax on tax over $5,554 and additional surtax of 36% on tax over $7,108.

2025 Tax Rates Ontario Printable Forms Free Online, Here are the tax brackets and corresponding rates for 2025:

47,714 a year after taxes in Ontario in 2025, Ontario applies a progressive income tax system with different rates depending on taxable income.

State Corporate Tax Rates and Brackets, 2025 Taxes Alert, See your tax bracket, marginal and average tax rates, payroll tax deductions, tax refunds, and.

Tax Calculator 2025 Ontario Image to u, Based on the updated 2025 federal tax rates, the first $55,867of your income is taxed at 15%, which works out to $8,380.05.