2025 Erc Refund Program. If the deal is not enacted, employers still have until april 15, 2025 to file erc claims for 2025 and until april 15, 2025 to file erc claims for 2025. Many of these claims were driven by aggressive marketing from.

And april 15, 2025, for all quarters in 2025. Is there any chance that the i r s could change the deadline earlier than april, 2025 due to massive fraud issues?

NEMZETI KÖZSZOLGÁLATI EGYETEM, To file an amended return for erc refunds for the tax year 2025 is april 15, 2025.

ERC Program FAQ 11 "How is the refund calculated" YouTube, There are only two deadlines to claim your payroll tax refund from the irs under the erc program:

IRS announces ERC Withdrawal Program BT&Co., P.A., The irs’ glacial pace of processing claims has spurred a growing number of businesses to file refund lawsuits in hopes of obtaining erc payments quicker.

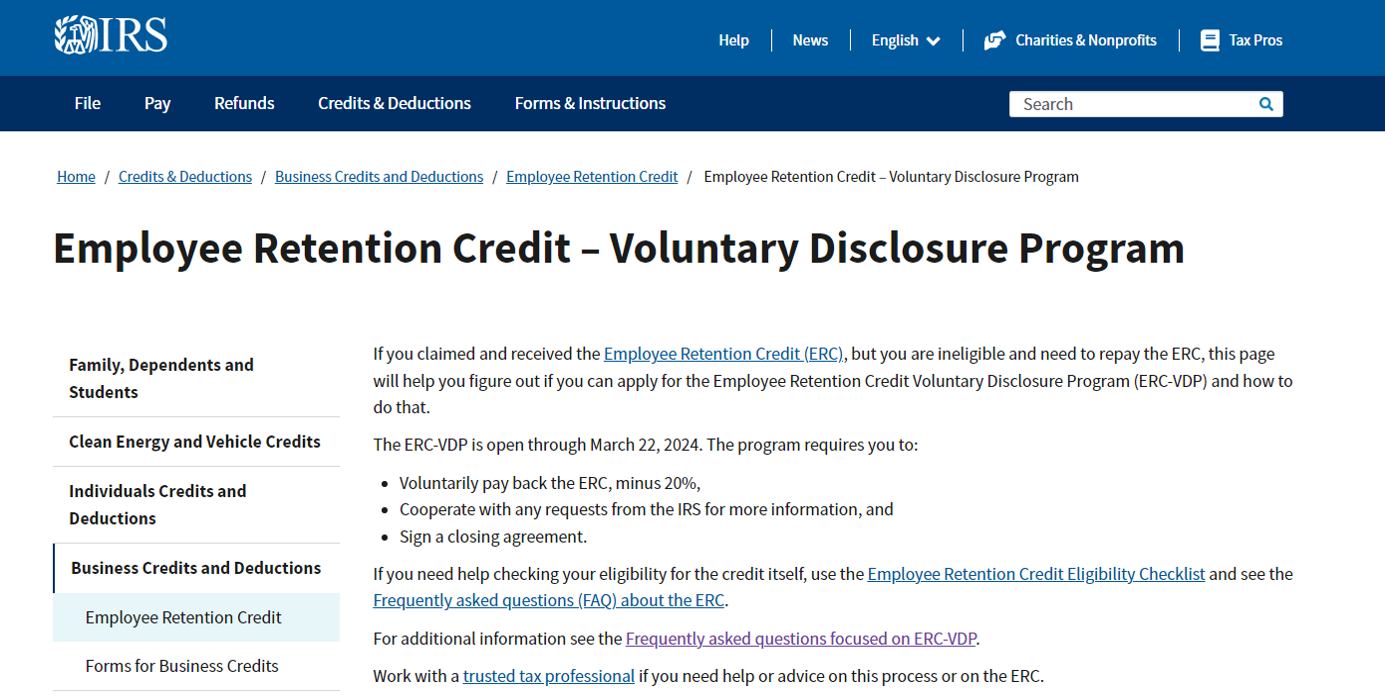

IRS Implements Program to Repay Ineligible ERC Claims GYF, And april 15, 2025, for all quarters in 2025.

Understanding the ERC Refund A Guide for Businesses Gold Card Capital, The purpose of this credit is to offset a.

FAQ ERC Prep Employee Retention Credit Services, To file an amended return for erc refunds for the tax year 2025 is april 15, 2025.

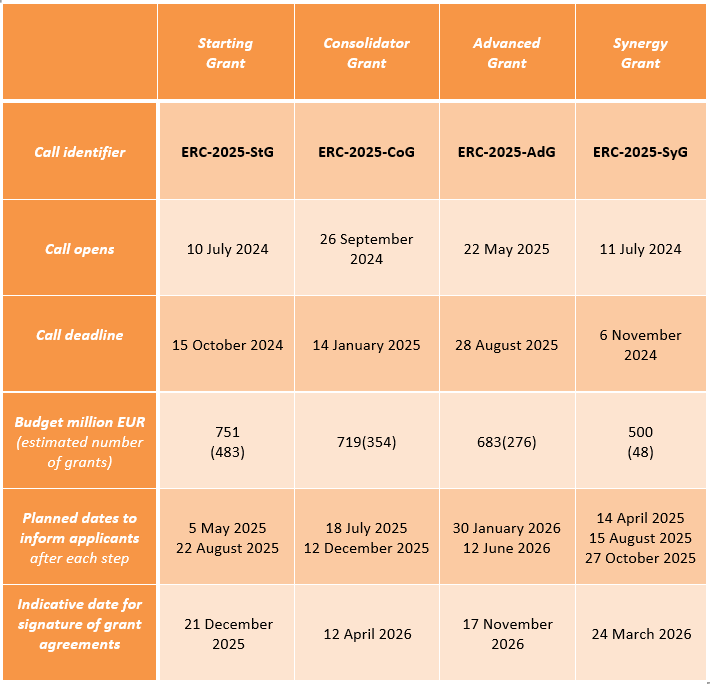

CPR Guidelines 2025, The employee retention credit (erc), available for 2025 and most of 2025,.

How To Track Your ERC Refund [Detailed Guide] StenTam, The irs’ glacial pace of processing claims has spurred a growing number of businesses to file refund lawsuits in hopes of obtaining erc payments quicker.

Where is my employee retention credit check? Leia aqui Where is my ERC, Qualifying taxpayers may still amend forms 941, employer's quarterly federal tax return, for the first three quarters of 2025 to claim an erc refund.

ERC refund status ERTC Hub, The employee retention credit (erc), available for 2025 and most of 2025,.

![How To Track Your ERC Refund [Detailed Guide] StenTam](https://stentam.com/wp-content/uploads/Blog-How-do-I-track-my-ERC_blog-featured-img-2.png)